Shared Purpose in Banking: Merging Community Investment (CRA) with Customer Loyalty

By Catalin Serban in Blog

November 06, 2023 22:00

"An organization’s success has more to do with the clarity of shared purpose, common principles, and strength of belief in them than to assets, expertise, operating ability or management competence, important as they may be.” - Dee Hock, founder and former CEO of Visa Inc.

The Community Reinvestment Act (CRA) stands as a testament to this very philosophy. Even 30 years after Hock's observation, banks continue to navigate the fine balance between their obligations and their deeper commitments to the communities they serve.

In many ways, the CRA is the Cinderella story of the banking world: significant yet often hidden from the limelight. It's more than just an obligation; it's an embodiment of that shared purpose and common principle Hock spoke of. At its core, CRA is about fostering development, supporting communities, and investing in the places we call home. But what if we changed the narrative? What if, instead of it being a regulatory footnote, CRA became a centerpiece of a bank's engagement with its customers?

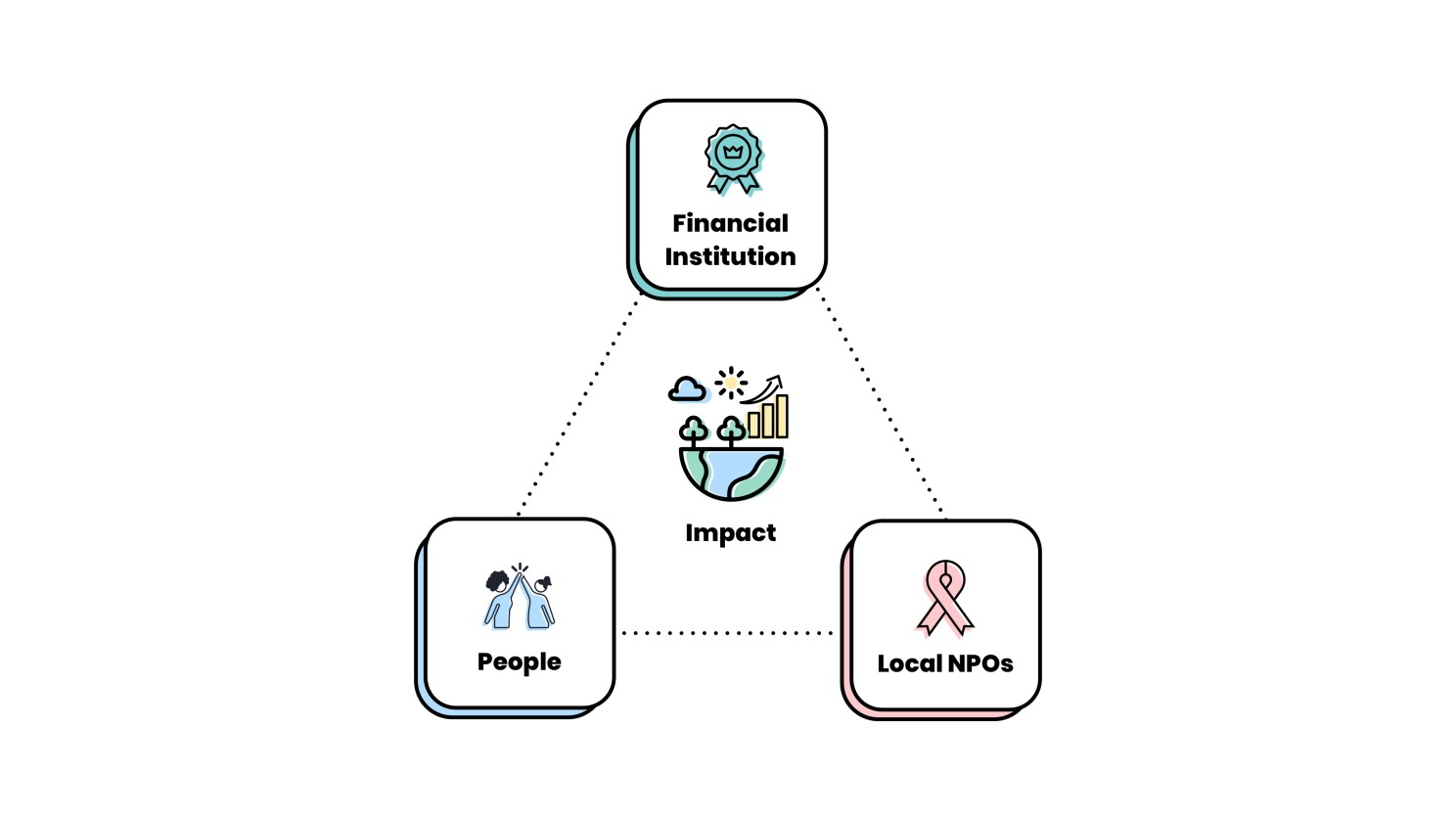

Enter the CX Fintech Empowerment Suite by in/PACT. Designed to seamlessly connect banks with vetted nonprofit organizations, our CX Fintech Empowerment Suite acts as the bridge between a bank’s regulatory efforts and its broader community. It's not just about ticking off compliance boxes; it's about embedding social responsibility into the very fabric of the banking experience.

Modern banking is about more than transactions; it's about transformation. Today’s customers don’t just want to be consumers; they want to be co-creators. They're not passive observers; they're active participants in a shared story. They want their banking choices to reflect their values, to be part of a bigger purpose — one that they share with their bank.

Benefits of Integrating CRA into a Bank's Loyalty Strategy:

Aligned Values

- Consumer Expectations: Younger generations, including millennials and Gen Z, are now looking for businesses that wear their social responsibility on their sleeves. Integrating CRA efforts into loyalty programs means banks can reflect this commitment in real-time.

- Shared Goals: When banking becomes a means for customers to contribute to broader social goals, it strengthens their connection and loyalty to the bank.

Rewards with a Purpose

- Charitable Contributions: Allow customers to use their loyalty rewards to support CRA-qualified community projects.

- Matched Donations: Amplify the impact by matching loyalty-driven donations, making every point count double.

Gamification and Engagement

- Impact Tracking: Give customers a tangible sense of their contributions through an interactive dashboard.

- Milestones and Achievements: Recognize and reward community-centered behaviors, turning banking into a shared journey of positive impact.

Showcase Bank's Dedication and Broaden Visibility

- Streamlined Donations: Simplify the donation process and provide a transparent channel for banks to reveal their commitment to community betterment.

- Beyond Compliance: Moving past mere compliance and transactional engagements, this approach demonstrates a bank's deep-seated commitment to the communities it serves.

- Prominent Collaborations: Spotlighting community partners to emphasize the cooperative nature of these initiatives.

- Outreach Amplification: Utilizing matching campaigns, roundup programs, and social impact gamification, banks can further enhance their community involvement's visibility, positively molding public perception and potentially improving CRA ratings.

Incorporating CRA into a loyalty strategy is more than just a savvy business move. It's a statement that a bank isn't just in the community – it is a part of it. It’s an opportunity for banks to not only meet CRA requirements but to amplify their impact, transform customer relationships, and truly invest in the future of their communities.

A Story of Success: Connecting Community Investment Efforts with Loyalty

Take a moment to explore the power of community-focused initiatives through the lens of a big brand like Target with its Community Giving program. Although Target isn't in the banking sector, their strategy provides a powerful example. Through a skillful blend of purpose and partnership, Target has brought its customers onboard as essential partners in their quest to invest in local communities.

Central to this is Target Circle, a program designed with community impact at its heart. As a member of Target Circle, every trip to Target earns customers a vote, a voice. These votes then become the compass, guiding Target's funds to the nonprofits of the community's choice. With every concluded voting cycle, grants find their way to the deserving nonprofits based on the proportion of votes they've garnered.

The brilliance lies in this symbiotic relationship, a confluence of community investment and customer loyalty, moving forward with a unified, shared purpose.

Now, transport this vision to the realm of banking. Envision a world where banking goes beyond mere transactions, turning into a medium of genuine impact. It's about evolving from 'Banking For Impact' to 'Banking With Impact'. Imagine a scenario where your bank's mission resonates with the core values of your stakeholders. It’s a journey from "Investing For Communities" to "Investing With Communities", a collaborative growth narrative where every player has a significant role.

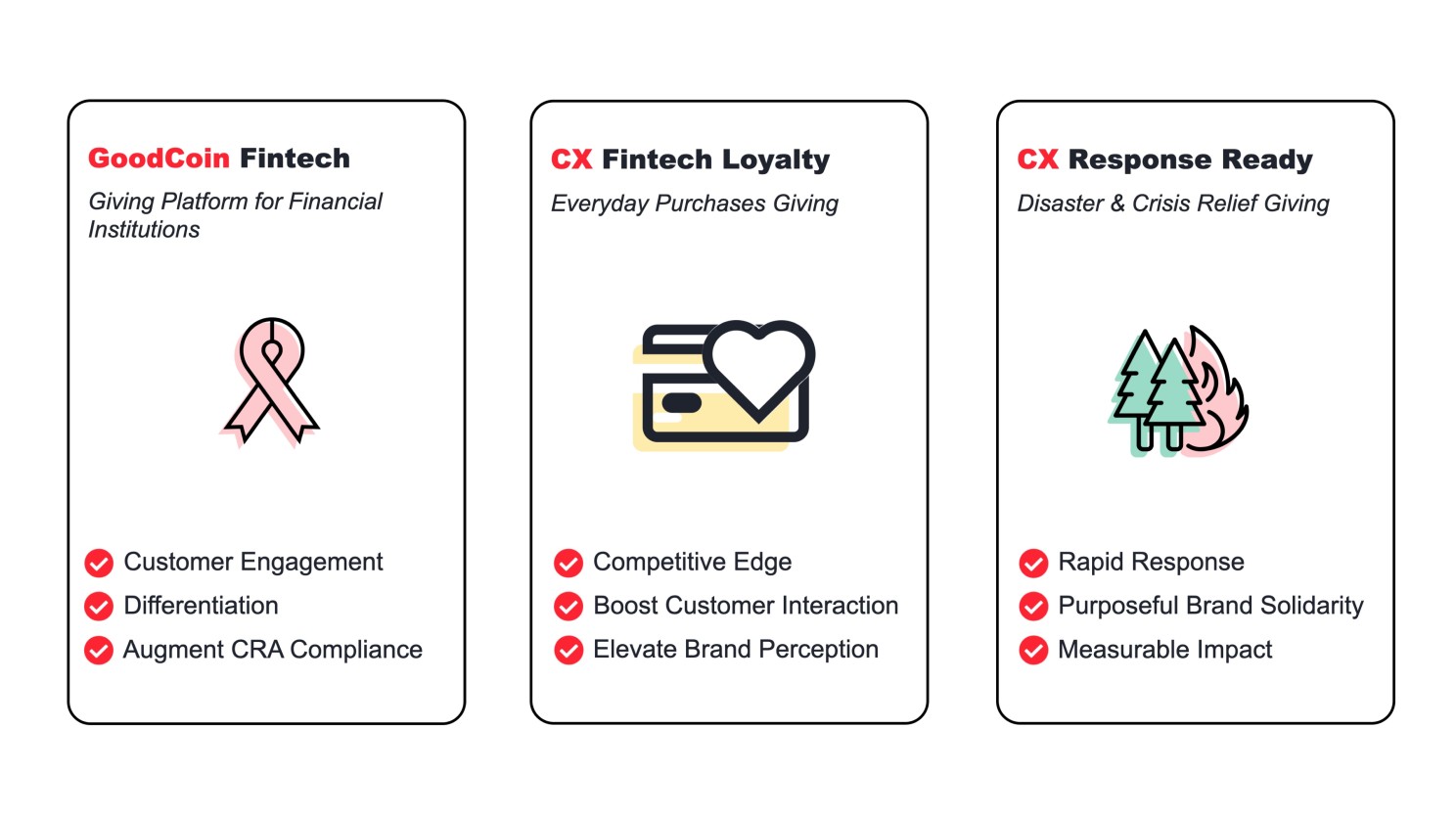

Within the CX Fintech Empowerment Suite, tools have been crafted to enhance both CRA and bank CSR initiatives:

Philanthropy Unlocked for Financial Institutions (FIs): A white-label solution that introduces charitable endeavors within digital banking, igniting customer-driven generosity.

- Monthly and one-time charitable donations

- Round-up giving and matching gift campaigns

- Access to 1.6 million IRS-sanctioned NPOs

- Dedicated support for CRA campaigns

- Localized solutions for branch-specific NPOs

Loyalty Rewards That Drive Change: Transition everyday actions into self-funding loyalty ventures that resonate deeply.

- The program is funded by interchange fee revenue

- Customers are empowered to allocate a percentage of their purchase to their chosen local NPO

- A cost-efficient yet impactful loyalty model

- Harnesses existing payment channels

- Amplifies customer loyalty and emotional bond

- Opens a new donation channel for local communities