To achieve financial inclusion, banks and payments tech can't be enemies

By Elena Pierce in Blog, External Articles

February 07, 2019 05:00

As a 25-plus-year veteran of banking and payments, I’ve witnessed the financial services industry struggle to keep its core business models relevant to rapidly evolving consumer expectations.

The digital revolution has put banks and credit unions under pressure to innovate, to make their services more real time, more personalized and even more purpose-driven.

Up-and-coming fintechs are giving the financial service behemoths a run for their money (pun intended). Big banks often get a bad rap as capitalists simply out to make investors and their executives very wealthy. And, from time to time, that has proven to be undeniably true. On the other end of the spectrum within the financial service industry, credit unions, which are non-for-profit versions of banks, are known to pour their hearts and souls into their members, and by extension the communities in which they operate.

The reality, of course, is more nuanced. Both banks and credit unions in fact do a lot today to better the world. Collectively, they pour billions of dollars into their communities and causes that align with their respective mission.

Additionally, they provide loans to small businesses which fuel local economies. And, their employees donate countless hours to causes they care about.

But, have these institutions learned how to take these social good missions full circle? Despite their current efforts, little has been done to make their traditional social good and corporate philanthropy initiatives truly meaningful to their customers or members.

I’ve been intrigued about the frenemy status of financial institutions (FIs) and fintechs since the latter first emerged on the scene. At first, sitting in my banking seat, we were worried. Then, we realized “they” were single solution providers that couldn’t begin to compete with the depth and breadth of what we (a big bank) had to offer and took great solace in that the vast majority of their founders knew nothing about banking but were just great at software technology.

Then, the rest of consumer life started evolving into experiences that were way more convenient and intuitive. Mobile phones, tablets and laptops were proliferating, and apps and software were being developed to solve every possible need or make everything that much more convenient.

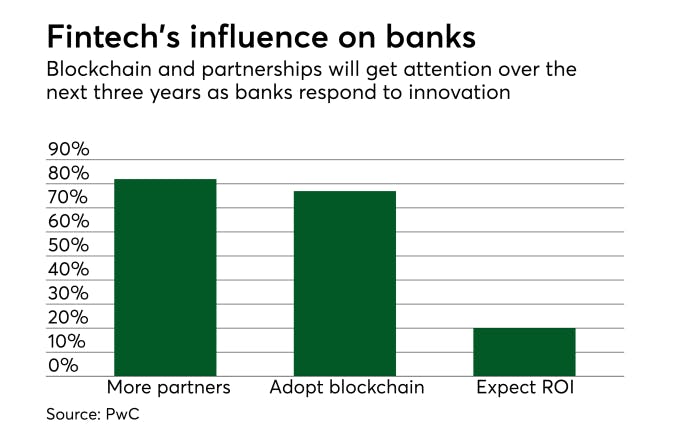

Meanwhile, both banks and credit unions, stuck on their respective complicated platforms of legacy systems, tied precariously together, realized that they weren’t evolving fast enough to compete with the consumer experiences happening in every other aspect of life. And, that’s pretty ironic given that “banking” represents the thread of multiple touch points in everyday life. Finally, the door to collaborating with fintechs slowly started to open, and enemy status moved to frenemy and for many, now true friendly alliances.

So, what do these major transformations have to do with how FIs need to think about charitable giving? First, they need to consider the huge opportunity. Of the $400 billion given to charity in the U.S. last year, more than 70% of that was from individuals. Traditionally paid by check, cash or credit card, increasingly these payments are migrating to digital platforms outside the traditional banking ecosystem.

Read the Original Article on on PaymentsSource.